nc sales tax on food items

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Sale and Purchase Exemptions.

Understanding California S Sales Tax

This document serves as notice that effective January 1 2009 there is a new exemption from State sales and use tax for bakery items sold without eating utensils by an.

. North Carolina has 1012 special sales tax jurisdictions with local sales taxes in. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically. Click here for extremely detailed guidance on what grocery items are and are not tax exempt in New York.

Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Sales tax is a tax that is applied to the cost of the product when sold to a consumer which can.

Some states charge a lesser sales tax on food items as of 2022 including. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the.

The transit and other local rates do not apply. Counties and cities in North Carolina are allowed to charge an additional. Sales and Use Tax Rates.

North Carolina Sales of grocery items are exempt from North Carolina. Nc sales tax on food items Friday July 29 2022 Edit. Is Food Taxable In North Carolina Taxjar.

Several examples of exemptions to the state sales tax are prescription. Appointments are recommended and walk-ins are first. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

This page describes the. Some examples of items that exempt from. Cottage food is typically defined as food items that are produced in a home kitchen.

Sales tax in North Carolina is between 475. Counties and cities in North Carolina are allowed to charge an additional. North Carolina has a 475 statewide sales tax rate.

Tax As An Expense Every Time I Pay It Or Is That Automatically Figured. Sales Tax Exemptions in North Carolina. The general State and applicable local and transit rates of sales and use tax apply to the sales price of each article of tangible personal property that is not subject to tax under another.

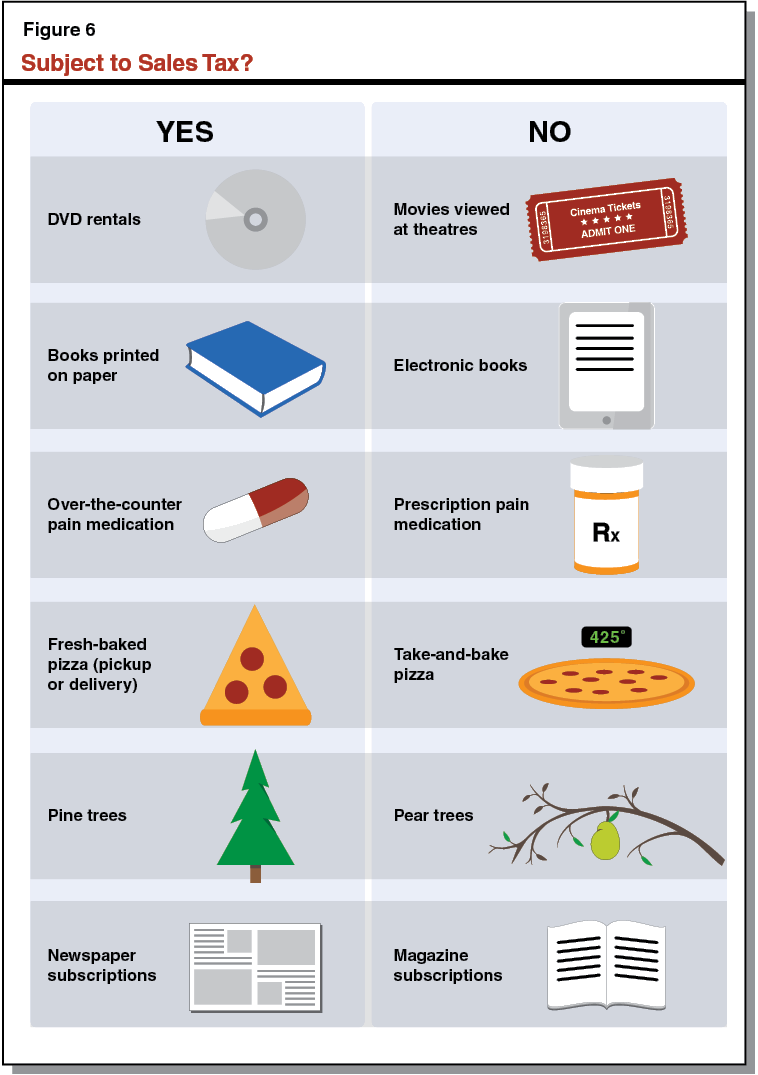

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Currently food consumers pay the local 2 sales tax on most groceries and the full 675 combined statelocal rate on certain items including candy soda prepared foods. In North Carolina certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Is Food Taxable In North Carolina Taxjar Sales Tax On Grocery Items Taxjar Sales Tax On Grocery Items Taxjar. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax.

State Level Sales Taxes On Nonfood Items Food And Soft Drinks And Download Table

How To File And Pay Sales Tax In North Carolina Taxvalet

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Etsy Sales Tax When And How To Collect It Sellbrite

Business Guide To Sales Tax In North Carolina

Sales Taxes In The United States Wikipedia

General Sales Taxes And Gross Receipts Taxes Urban Institute

Sales Tax On Grocery Items Taxjar

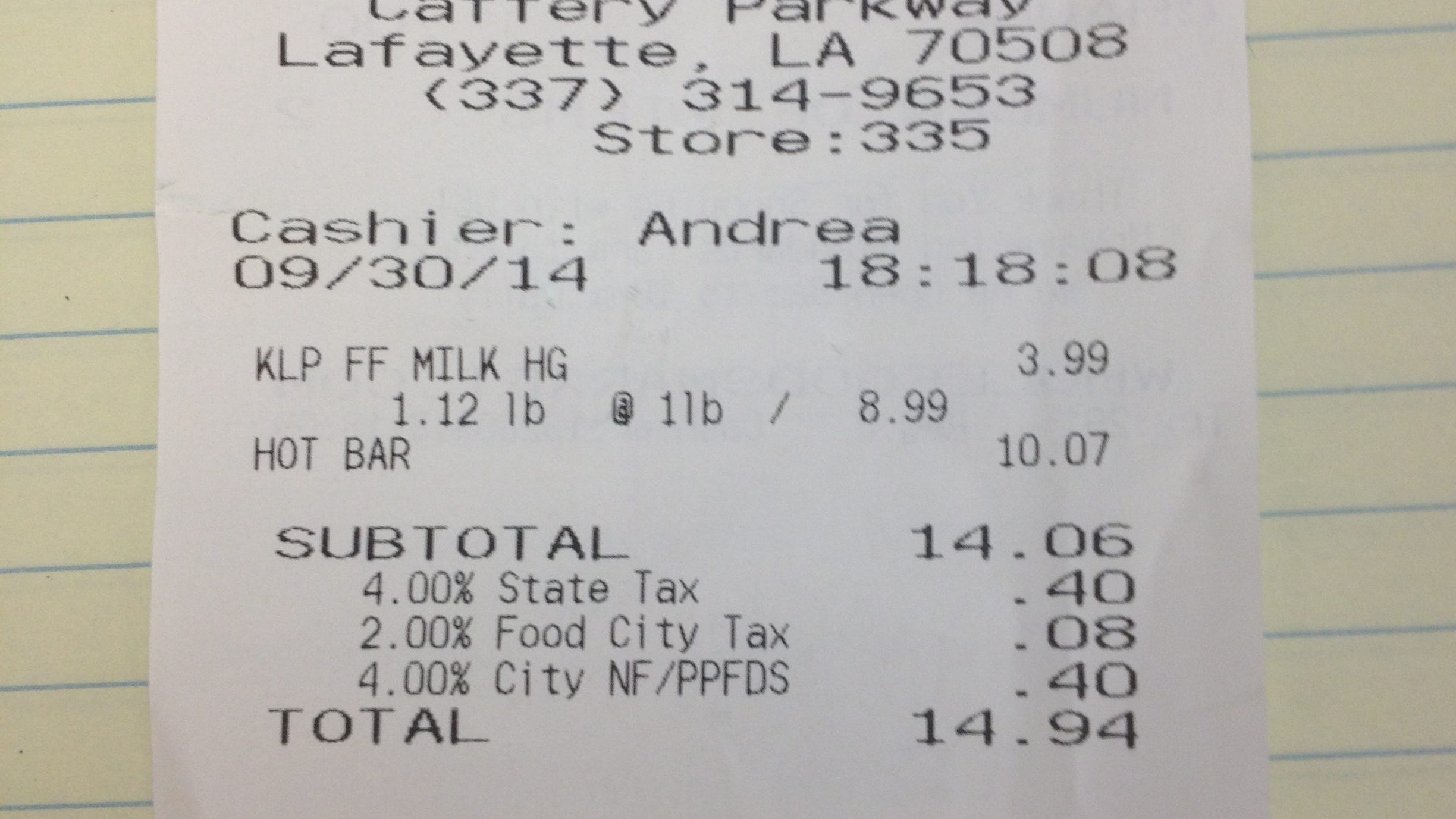

Whole Foods Collecting The Right Amount Of Sales Tax

General Sales Taxes And Gross Receipts Taxes Urban Institute

4 Ways To Calculate Sales Tax Wikihow

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

How Are Groceries Candy And Soda Taxed In Your State

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

Sales Tax Calculator And Rate Lookup Tool Avalara

Sales Tax Laws By State Ultimate Guide For Business Owners

Here S A Tax Guide For Nuts Wsj

E 585 2009 Form Fill Out Sign Online Dochub

More From County Commissioners Budget Workshop Lincoln Herald Lincolnton Nc